Search in ideas for "yes bank"

Yes bank latest breakout Since 4 January 2021, this stock is trading in the range of 18.65 and 13.95. But in today's trading session the stock has given a good upside breakout with higher volume. The volume is approximately 336m, which is very higher as compared to the previous candle. Now this stock will face resistance at 16.90 rupees price level, If this stock breaks this price level then this stock will give a very good upside target. But wait for price action, usually, when any stock gives a breakout, the stock will retest its breakout resistance, which is now acting as major support.

Yes bank support and resistance for upcoming trading session

Support : 15.50 / 13.95

Resistance : 16.90 / 18.60

Conclusion

If stock successfully retests the 16 rupees price level, today's breakout is valid. Otherwise, this is a false breakout. So wait for price action, don't jump into the trade because of just one reason, and the reason is, the stock has given 16% upside movement in today's trading session.

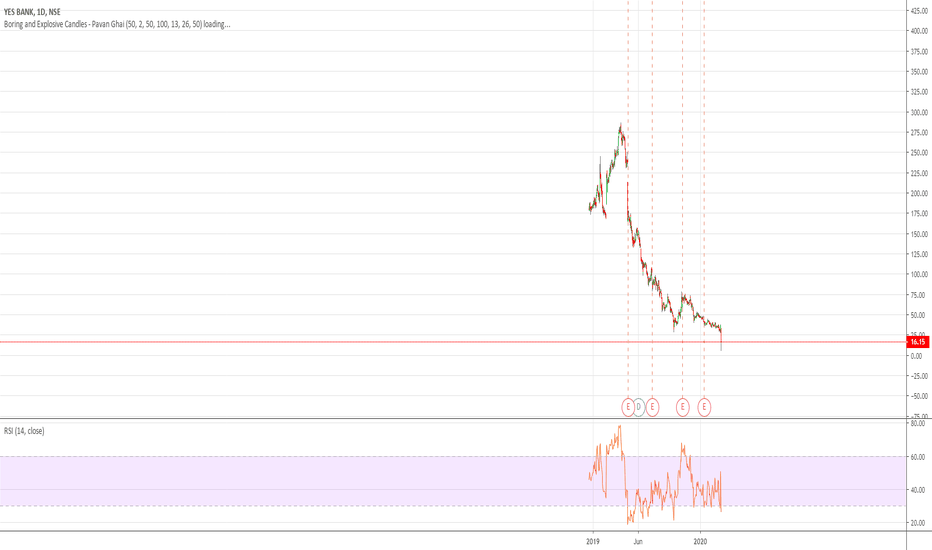

Yes Bank ... Fallen Angel: To bottom fish or not to bottom fishOnce upon a time, Yes Bank was in my portfolio too. Thankfully I exited the stock when it was above 300. The human mind naturally seeks to bottom fish such fallen angels. Here are some facts you have to consider.

There is yet another Earnings report in 2 days.

There was a massive selling volume of more than 10 times average for 2 continuous days and price closed near the lows. This can be a climatic selling. Though we have to wait for a few more days to confirm a bottom. A simple test for bottom formation can be to wait for at least three days where the low is not breached and preferably a small or big bounce is seen. A more rigorous test will be to wait for the candle high of the bottom to be taken out along with the 3 days rule.

Given the rock bottom state of affairs, it is a laggard and hence will not be on my radar for longs and I will not go short without full hedge as the runway is very small and it can make a sharp u turn anytime. If I were a bottom fisher, I will wait for the price to bounce at least 20% from the new low(to be formed) before I even consider a testing quantity.

YES BANK LAW OF SATURN (TREND REVERSAL)LAW OF SATURN - 29.44 YEAR OF ORBITAL CHANGE .

ONE THIRD 1/3= 120*-3585 DAYS(TREND REVERSAL )

TWO THIRD 240*-7170 DAYS (TREND REVERSAL)

3 MAR 2008- SUPPLY ZONE

9 MAR 2009 - DEMAND ZONE

21 AUG 2018 - SUPPLY ZONE STARTED

30 APRIL 2020- MAY BE A DEMAND ZONE ( ALL DEPENDS UPON SBIN/ LIC , RBI & YES BANK MANAGEMENT)

NOTE:SUPPLY/DEMAND ZONES ARE MARKED UPON MAJOR REVERSAL & SATURN LAW FACTOR

YES BANK SATURN LAW ANALYSISLAW OF SATURN - 29.44 YEAR OF ORBITAL CHANGE .

ONE THIRD 1/3= 120*-3585 DAYS(TREND REVERSAL )

TWO THIRD 240*-7170 DAYS (TREND REVERSAL)

3 MAR 2008- SUPPLY ZONE

9 MAR 2009 - DEMAND ZONE

21 AUG 2018 - SUPPLY ZONE STARTED

30 APRIL 2020- MAY BE A DEMAND ZONE ( ALL DEPENDS UPON SBIN/ LIC , RBI & YES BANK MANAGEMENT)

NOTE:SUPPLY/DEMAND ZONES ARE MARKED UPON MAJOR REVERSAL & SATURN LAW FACTOR

Long YES BANKYes bank not breaking support . I think holding positions up to march/april will do. It can go up to the resistance mentioned at the arrow . Also SMA 50 and 200 can form golden cross again . The thing we have to take care of is the day when EPS comes around 13 jan the stock may crumble . If the stock holds through the week of EPS distribution the chances of charts forming golden cross(When 50 SMA crosses above 200 SMA) rises and stock can go up to 150.